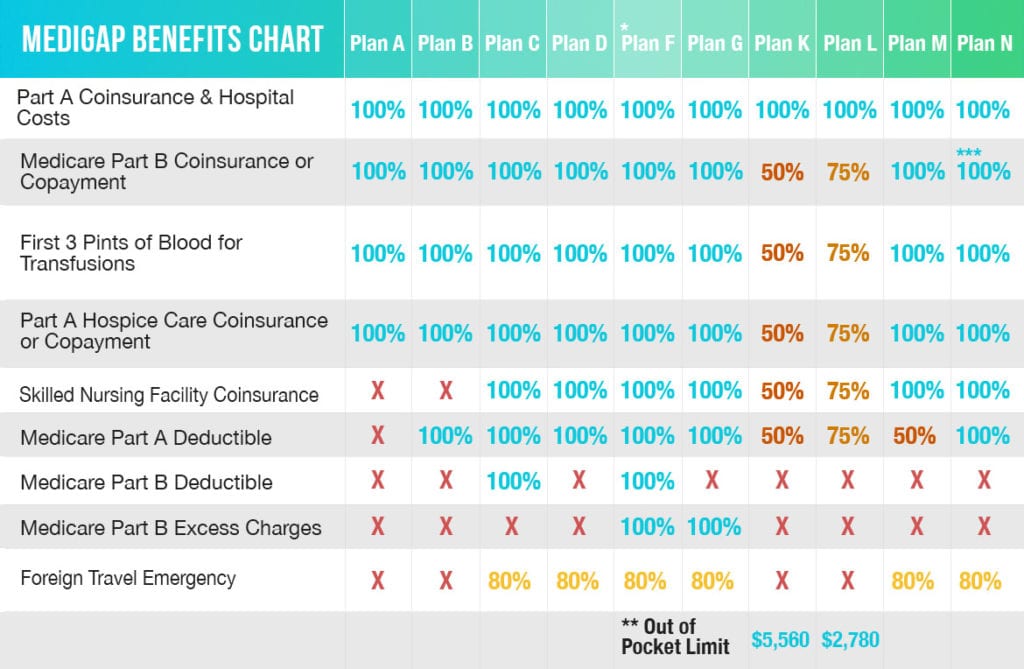

For residents of North Dakota, by applying online you save approximately 5%. If you qualify, the 5% discount will remain in effect for the life of the policy. Discount qualification determined by Cigna. If your spouse is added at the time of application, they are also eligible to receive the online discount per the same terms. If you do not complete the entire application online, and/or call to have an agent submit your application by phone, you will not qualify to receive the online discount. You must submit your Medicare Supplement Insurance application online at to qualify for the discount. To qualify for the online discount, you must be a new Medicare Supplement policy holder with Cigna*, without an active policy in the last 90 days. Discount not available in CT, DC, FL, ID, MA, MN, NJ, NY, OH, OR, VA. Plan A: CNHIC-MS-AA-A-TN Plan F: CNHIC-MS-AA-F-TN Plan G: CNHIC-MS-AA-G-TN Plan N: CNHIC-MS-AA-N-TN. Tennessee Medicare Supplement Policy Forms In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin. Notice for persons eligible for Medicare because of disability: View Kansas disclosures, exclusions, and limitations Call to learn more and see if you qualify. Note: If you have been denied coverage by another company due to certain medical conditions, we may be able to cover you. For residents of WA, the discount is referred to as Spousal Premium Discount, and only applies to spouses. Discount not available in HI, ID, MN, and VT. Contributions toward the plan deductible include the Medicare Part B deductible, but do not include the plan’s separate foreign travel emergency deductible. The Medicare deductible changes each year, per Centers for Medicare & Medicaid Services (CMS) guidelines. The Medicare deductible changes each year, per Centers for Medicare & Medicaid Services (CMS) guidelines.ħ Plan N pays 100% of the Part B coinsurance, except for a copayment not to exceed $20 for some office visits and a $50 copayment for emergency room visits that don’t result in an inpatient admission.Ĩ High Deductible G pays the same as Plan G and requires payment for your costs (coinsurance, copayments, deductibles) for Medicare approved expenses up to the current calendar year deductible amount before the policy pays any benefits. Plans F and high-deductible F will not be available to applicants who are newly eligible for Medicare on or after January 1.Ħ High Deductible F pays the same as Plan F and requires payment of your costs (coinsurance, copayments, deductibles) for Medicare approved expenses up to the current calendar year deductible amount before the policy pays any benefits. Program availability may vary by location, and are not available where prohibited by law.ģ Health advocates are trained nurses and hold current nursing licensure in a minimum of one state, but are not practicing nursing or providing medical advice.Ĥ Product availability varies by state and company–get an online quote or call to confirm which plans are available in your state, and to verify complete coverage benefits.ĥ Only applicants eligible for Medicare before January 1, 2020, may purchase Plans F, and high-deductible F. Programs are provided through third party vendors who are solely responsible for their products and services.

The Healthy Rewards program is provided by Cigna Health and Life Insurance Company. Customers are required to pay the entire discounted charge for any discounted products or services available through these programs. Programs and services may be added or discontinued at any time.

In New Mexico and Idaho, insured by Cigna Health and Life Insurance Company.Ģ These programs are NOT insurance and do not provide reimburse ment for financial losses. In Maryland, North Carolina, Ohio, Pennsylvania, and Utah, insured by Cigna National Health Insurance Company domiciled in Ohio. American Retirement Life Insurance Company is not available to residents of Kansas and Kentucky. In Kansas, insured by Cigna National Life Insurance Company, Cigna Health and Life Insurance Company and Loyal American Life Insurance Company. View state disclosures, exclusions, and limitationsġ Insured by Cigna Health and Life Insurance Company, American Retirement Life Insurance Company, Loyal American Life Insurance Company or Cigna National Health Insurance Company.

0 kommentar(er)

0 kommentar(er)